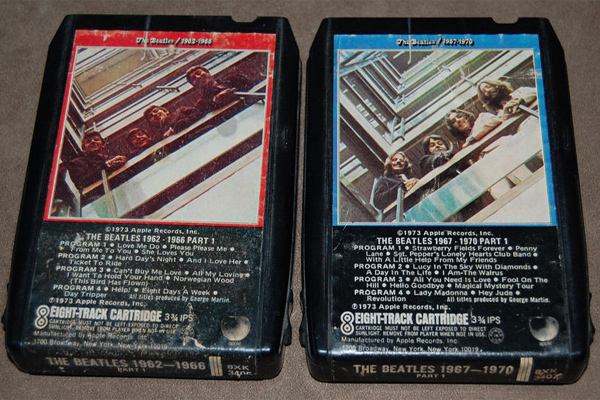

Vero Beach mortgage rules may be about to take a big change, and the jury is still out as to whether it could be bad for the mortgage industry in the long haul. If changes announced recently by Fannie Mae catch on, the process of having to fork over your pay stubs could go the way of 8-track tapes and […]