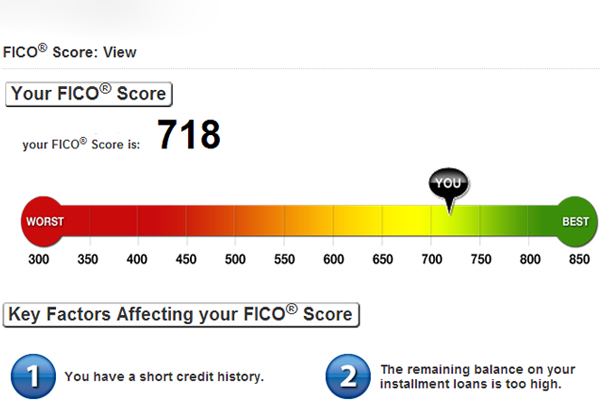

Vero Beach mortgages may be easier to get soon. A new calculation of credit scores will soon make it easier for millions of Americans to qualify for car loans and credit cards. The new methodology also could provide easier access to Vero Beach mortgages after tight post-recession lending standards shut millions of potential new homebuyers, particularly young Americans, out of […]