When you decide that owning a home is right for you, one of the big decisions you'll face is with your Vero Beach mortgage. Should you choose a 30-year fixed rate mortgage, or a 15-year fixed rate? Here are the advantages and disadvantages of these two popular options when it comes to getting a Vero Beach mortgage… We can help […]

Vero Beach Short Sales vs Foreclosures

There is still confusion today over the difference between Vero Beach short sales and foreclosures, so we wanted to hit the highlights of each in this short real estate minute video. Both Vero Beach short sales and Vero Beach foreclosures will negatively impact your credit and ability to buy another home, but going the short sale route may give you […]

Vero Beach Cash Out Refi May Be History

A Vero Beach cash out refi may soon be a thing of the past, and has in fact, already tumbled from a peak of $320 billion in 2006 to just $32 billion in 2013. During the housing boom of the mid-2000's, a Vero Beach cash out refi became a popular outlet for homeowners. Homeowners were encouraged to think of their […]

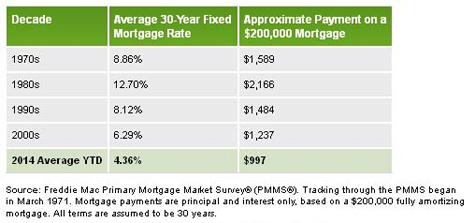

Putting Vero Beach Mortgage Rates Into Perspective

It's pretty much a foregone conclusion that Vero Beach mortgage rates have already hit their all-time low when the benchmark 30-year fixed rate was 3.31 percent in November 2012. Vero Beach home buyers won't see that level again. But the point the folks at Freddie Mac are making is this: Vero Beach mortgage rates right now remain historically low. Remember […]

Vero Beach Mortgages: ARM’s Making a Comeback

When it comes to Vero Beach mortgages, it appears that adjustable rate loans are becoming more popular once again. Adjustable-rate mortgages, whose rates can jump after a few years, are believed to have been one of the biggest culprits of the housing crisis. However, banks say they are concentrating on making the loans to buyers with strong credit who are […]