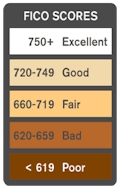

If you’re looking to buy a Vero Beach home you probably already know that your credit score is important. But if you have a low credit score, you do still have options. First, you should figure out what lenders expect of your credit score, since you might be surprised to find that you can indeed buy a Vero Beach home […]