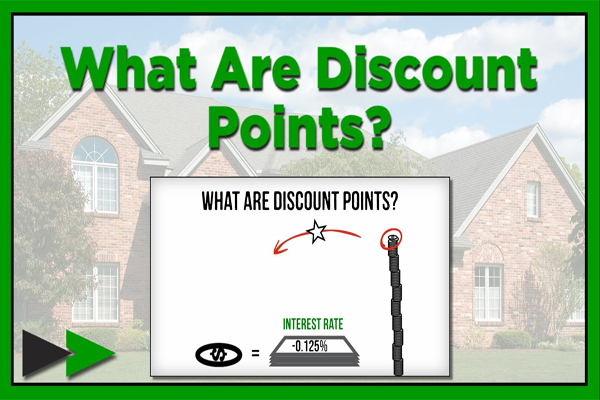

Vero Beach mortgage loan experts say over 6 million people nationwide will buy homes next year. Statistics expect roughly 2 million will be first-time homebuyers. Both first-time buyers and others always wrestle with whether or not to pay “discount points” on their mortgage. The Vero Beach Mortgage Loan: Points? Just what the heck are discount points, anyway? Mortgage discount points are a […]