When it comes to the Vero Beach mortgage market, these days the choices can be a little confusing. Mortgages typically fall into one of three categories: fixed rate, adjustable rate (or ARM) or hybrids (a combination of features of both fixed rate and adjustable rate offerings.) No matter which type you choose, it’s best to select the Vero Beach mortgage […]

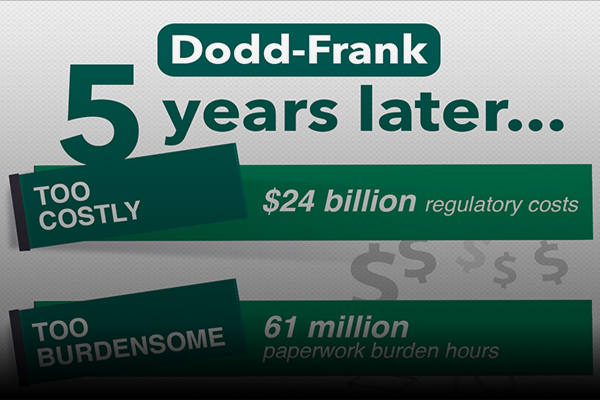

Dodd-Frank Effect on Vero Beach Real Estate

In many ways, the Vero Beach real estate market is still paying for the sins of lax lending practices in the last housing boom. It's been five years since the Dodd-Frank financial reform bill was enacted, putting into motion new credit extension and lending rules for mortgage lenders. What it Means for Vero Beach Real Estate The Dodd-Frank legislation encompass reams […]

Proven Ways to Lower Your Vero Beach Mortgage

A Vero Beach mortgage is probably the single largest monthly obligation you'll ever have if you own a home here. Everybody likes saving money, whether they live in Vero Beach or another American city! And whenever you're able to save money it's especially satisfying. There are, among potential others, at least a half-dozen ways you may be able to reduce […]

How Much Vero Beach Home Can You Buy?

Trying to figure out how much Vero Beach home you can buy with your income can be tricky, even though there are calculators everywhere that are supposed to enable you to figure out exactly how much you can afford. Certain variables not taken into consideration by a calculator can cause your individual figure to differ from someone else. Online calculators […]

Delinquent Vero Beach Mortgages Continue to Fall

The number of delinquent Vero Beach mortgages continues to fall, but the foreclosure crisis is still taking its toll on thousands of borrowers locally, and hundreds of thousands nationwide. Nationally, of the approximately 952,000 borrowers who are 90 or more days past due on their monthly payments but not yet in foreclosure, 62 percent have already been through some form […]