Vero Beach mortgages may be easier to get soon. A new calculation of credit scores will soon make it easier for millions of Americans to qualify for car loans and credit cards. The new methodology also could provide easier access to Vero Beach mortgages after tight post-recession lending standards shut millions of potential new homebuyers, particularly young Americans, out of the market.

The Fair Isaac Corp., which issues credit scores used in 90 percent of U.S. consumer lending decisions, says it will give less weight to unpaid medical bills when assessing creditworthiness, starting this fall. It also won't penalize a borrower's credit score if they've had bills settled with a collection agency.

FICO Changes for Vero Beach Mortgages Great for Consumers

Under FICO's current methodology, many potential borrowers either have been flat-out denied access to credit or forced to pay higher interest rates. Matt Fellowes, CEO of workforce optimization firm HelloWallet and a former Brookings Institution fellow, calls the changes "terrific improvements for consumers."

The revisions weren't necessarily a response to people's failures to pay medical bills, but rather intended to address punishment for bills they might not even know they had.

Over half of collections on credit reports are associated with medical bills, according to the Federal Reserve, and a May Consumer Financial Protection Bureau study found that some credit scoring models may overly penalize consumers because of medical debt. The score disadvantage – up to 25 points – could cost someone tens of thousands of dollars in interest over time on bigger loans like Vero Beach mortgages.

This move will ultimately make a real difference in the lives of millions of Americans, who have been shut out of the housing market or forced to pay higher rates for Vero Beach mortgages because of flawed credit scores.

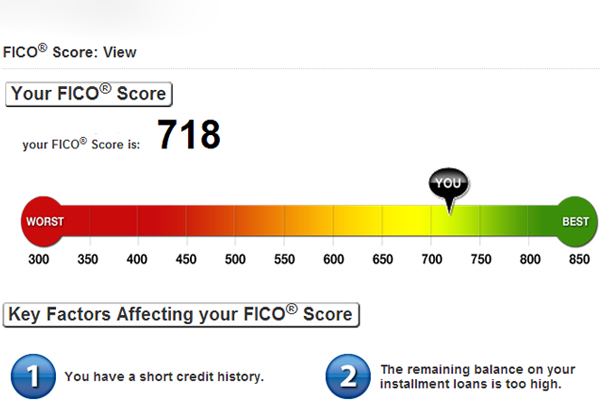

The advice from most mortgage professionals to first-time home buyers is to begin sprucing up their credit at least six months before applying for any Vero Beach mortgages. FICO scores seen by lenders are not what are sold to consumers by the three national credit reporting agencies. The only way consumers will know for sure how their credit looks to lenders is by applying for pre-approval or filling out a mortgage application.

Check out our other articles and news affecting Vero Beach mortgages by clicking on the Vero Beach Mortgage Info link to your right under Vero Beach Real Estate Categories.