A combination of rising Vero Beach home prices and higher interest rates are making home affordability increasingly out of reach for many.

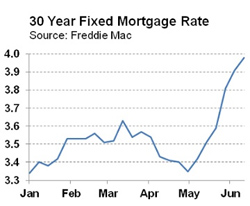

Even at 4 percent, the long-term mortgage rate has been in historical territory not seen in 60 years since the low for the 30-year fixed was set at 3.31 percent last November. Interest rates for 30-year fixed-rate mortgages have risen about 0.5 percentage points over the past several weeks and are expected to hover between 4.0 and 5.0 percent during the second half of 2013.

Even at 4 percent, the long-term mortgage rate has been in historical territory not seen in 60 years since the low for the 30-year fixed was set at 3.31 percent last November. Interest rates for 30-year fixed-rate mortgages have risen about 0.5 percentage points over the past several weeks and are expected to hover between 4.0 and 5.0 percent during the second half of 2013.

Vero Beach Home Prices Still Within Reach

Combined with rising Vero Beach home prices, affordability is out of reach already for a typical household according to Freddie Mac's monthly housing market outlook for June.

Freddie Mac vice president and chief economist Frank Nothaft thinks while rising interest rates will reduce housing demand, rates would have to increase considerably more before the reduction in demand for home purchases would be substantial.

Freddie Mac believes that at today's Vero Beach home prices and income levels, mortgage rates would have to be nearly 7 percent before the median priced home would be unaffordable to a family making the median income in the Vero Beach area.

With high affordability, markets can absorb a further rise in mortgage rates before we would expect housing activity to slow substantially. After all, real interest rates are still half of what they were prior to the recession and are still very low by historic standards.

Look for a sharp decline in refinance volume in the second half of this year. Freddie Mac projects that refinance originations will total about $1.1 trillion in 2013, down from $1.5 trillion in 2012.